Electrolyte shipments in a single month surged 8 times

Behind this item, it is predicted that the Shanshan electrolyte business is undergoing quantitative and qualitative bipolar nuclear changes.

As the world's number one integrated supplier of lithium materials, Shanshan's positive and negative business relies on the rapid development of the domestic power battery market, achieving a leap in performance and market rankings. But for a long time, the electrolyte has been considered as a shortcoming of the business of Shanshan lithium battery materials.

After a keen judgment on the current domestic and international market environment changes and pre-precipitation, Shanshan's electrolyte business has launched a new planning direction: with high-end lithium hexafluorophosphate as the leading factor, and Japan and South Korea customers to develop the latest high-energy density additives, second-generation solvents, etc. In order to form a layout layout of the electrolyte integrated industry, we are committed to becoming "the world's leading supplier of lithium battery electrolytes".

The strategic vision of carrying Shanshan Electrolyte is Shanshan New Materials (Zhangzhou) Co., Ltd. (hereinafter referred to as “Zhangzhou Shanshan”), a subsidiary of Shanshan.

In June 2016, Shanshan Co., Ltd. and Muhua Group jointly invested in the “Integration Project of 2000 tons of lithium hexafluorophosphate and 20,000 tons of lithium ion battery electrolyte”. After more than two years of investment, Cangzhou Shanshan has a production capacity of 20,000 tons of electrolyte, and became the first lithium hexafluorophosphate enterprise in China to adopt the dynamic crystallization process.

Building an electrolyte integrated industry map

It is well known that lithium hexafluorophosphate is the main raw material of the electrolyte, accounting for about 40% of its total cost, which determines the main performance of the electrolyte. At present, the structural contradictions of high-end production capacity and low-end and medium-end overcapacity in lithium hexafluorophosphate market are prominent. The electrolyte market pattern and lithium hexafluorophosphate linkage show the same characteristics. Although there is a contradiction in the structural capacity of lithium hexafluorophosphate, it is a market opportunity for the Shanshan electrolyte business.

Guo Li, general manager of Zhangzhou Shanshan, believes that the main reasons for the current situation of lithium hexafluorophosphate:

First, the supply of high-end lithium hexafluorophosphate capacity is insufficient. From a global perspective, high-end production capacity is still concentrated in the hands of three Japanese giants, Morita Chemical, Kanto Electrochemical and SUTERAKEMIFA. The three international giants mainly supply their core customers, and the export capacity is not large enough to meet the domestic electrolyte market demand.

Comparing the domestic and international markets, a clear contrast is that the capacity of lithium hexafluorophosphate giants, which are mainly based on Morita Chemical, is in short supply, and there is insufficient production capacity and no market price. However, with the release of new capacity, the price of lithium hexafluorophosphate has fallen by more than 50% compared with the previous two years.

Second, the technical threshold of lithium hexafluorophosphate is relatively high, and there are only a handful of companies that master high-end lithium hexafluorophosphate technology. At present, there are no more than 9 companies that produce lithium hexafluorophosphate in the entire domestic market, and only one company that can provide high-end products through dynamic crystallization.

From the technical route, lithium hexafluorophosphate production processes mainly include dynamic crystallization, static crystallization, and liquid lithium salts. Domestic companies are mainly based on static crystallization, while Japanese companies are dominated by dynamic crystallization. In comparison, the static crystallization is mechanically broken, the particles have poor fluidity, high impurities and high acidity; the dynamic process has complete crystallization, uniform particle size, good fluidity, low acidity, low insoluble matter, and electrolysis. The liquid has good conductivity and can be used with high nickel-based cathode materials to improve the performance of lithium batteries.

After understanding the structural contradiction of lithium hexafluorophosphate, it is also necessary to find out the supply and demand relationship of the electrolyte. According to the data of the High-Tech Research Institute of Lithium-Ion Research Institute (GGII), the actual demand for electrolytes in the domestic lithium battery market in 2017 was 110,000 tons, but the domestic total electrolyte production capacity exceeded 250,000 tons.

On the supply side, the existing production capacity exceeds 2 times the actual demand; on the demand side, domestic mainstream electrolyte companies feedback, customer demand for high-nickel high-voltage electrolyte is increasing, but supply capacity is insufficient.

Guo Li said that at present, Japan and South Korea's 3C lithium battery giants mainly purchase 4.4 ~ 4.45V electrolyte, and will follow the development of higher voltage 4.5V, relying on the existing lithium hexafluorophosphate, solvent, additive system, can not reach High temperature and high pressure requirements. To produce a matching electrolyte, the use of consistent, stable, high performance lithium hexafluorophosphate is the key.

In summary, the key to strengthening the industrial strength of Shanshan Electrolyte is: to build an electrolyte integrated industrial layout, focusing on high-end lithium hexafluorophosphate and electrolyte, to create a chain of industrial chains from high-end lithium hexafluorophosphate, combined with special solvents and additives, to high-end electrolyte products. . The most important part of the implementation is the production of lithium hexafluorophosphate by dynamic crystallization to create an unmanned production workshop.

The first phase of the electrolyte integration project was put into operation

In order to complete the above-mentioned electrolyte integration industry layout, Shanshan shares integrated the advantages of Zhangzhou's fluorine chemical industry, its own electrolyte advantages, and the shareholder's advantages of the chemical group's fluorine chemical production.

In 2016, Shanshan shares increased the capital of Zhangzhou Shanshan (formerly Juhua Kailan) and joined hands with the domestic fluorine chemical industry giant Juhua Group to jointly build an integrated product with an annual output of 2,000 tons of lithium hexafluorophosphate and 20,000 tons of lithium-ion battery electrolyte. Project." It can be said that this project is the actual version of the implementation of the Shanshan Electrolyte Integration Industry. After more than two years of construction, the 20,000 tons of electrolyte in the first phase of the project was put into operation in July 2017, and with the original 10,000 tons of electrolyte capacity, the total electrolyte capacity of Shanshan reached 30,000 tons; After mass production of 2,000 tons of lithium hexafluorophosphate at the beginning of the month, the total production capacity of lithium salt will reach 2,300 tons.

Guo Li believes that the domestic electrolyte market pattern will be rewritten in the past two years, whether it is the high-end customer demand for high-quality digital lithium batteries, or the demand for large-scale power battery customers driven by intelligent production of power batteries, the future electrolyte companies will not only compete It is only the production capacity, cost, financial strength, and more importantly, product quality. He is very confident in the electrolyte produced by the dynamic crystallization process of Cangzhou Shanshan to produce lithium hexafluorophosphate. From the perspective of product performance, Luzhou Shanshan lithium hexafluorophosphate insoluble matter, metal ions, acidity and other indicators are better than the industry standard indicators, and ranked in the forefront of peers. For example, the industry standard stipulates that the insoluble matter can reach up to 200ppm, but the measured index of the Shanshan product is much lower than the index.

In addition to quality assurance, the layout of the electrolyte integrated industry created by Zhangzhou Shanshan has also begun to take shape.

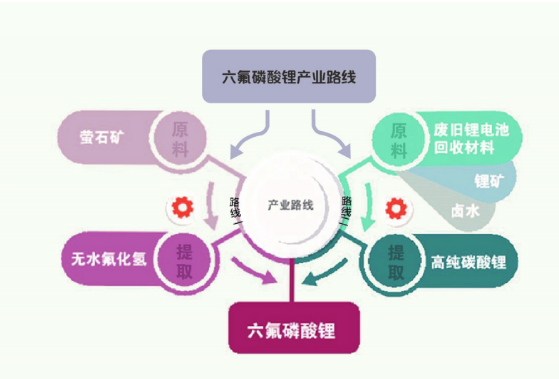

❶Build two lithium hexafluorophosphate industrial routes

In the industrial blueprint for the construction of Shanshan Electrolyte, the most important thing is to build two industrial routes around the core of lithium hexafluorophosphate, which is also an important part of the future market competitiveness of Shanshan Electrolyte. At present, one of the lithium hexafluorophosphate production lines has been opened up and has production capacity.

The first route is to extract and produce anhydrous hydrogen fluoride from the fluorite mine owned by the shareholder Juhua Group to make lithium hexafluorophosphate. This is the main production route of Luzhou Shanshan Phase I hexafluorophosphate project;

The second route is to extract high-purity lithium carbonate from lithium ore, brine, and waste lithium battery recycling materials, and to produce lithium hexafluorophosphate by its own process.

Regardless of the above-mentioned production routes, Luzhou Shanshan enjoys the most complete and complete fluorine industry chain advantage of Zhangzhou, the “China Fluorine Capital”. Many raw material suppliers are located in the same high-tech park as Zhangzhou Shanshan. Reduce transportation costs and production costs.

In addition to self-produced lithium hexafluorophosphate, the team of Zhangzhou Shanshan is also independently developing second-generation solvents and third-generation additives. Finally, these raw materials are researched and developed into high-end electrolyte products.

❷ Construction of an unmanned electrolyte integrated factory

Relying on the previous workshop-style production model has completely failed to meet the market demand for high-end lithium hexafluorophosphate. The construction of an automated and intelligent production workshop has become the hardware standard for Shanshan Electrolyte to achieve the global leading position in electrolytes.

To achieve unmanned factory, intelligent DCS system is needed to realize real-time data control. The intelligent software of the total control room is used for control of material addition, material transfer, mixing, mixing and warehousing.

In order to achieve intelligent control of the entire production process, the Zhangzhou Shanshan plant laid a dense fiber optic cable. It is understood that the total length of these cables exceeds 100,000 meters, and the cost of only optical fibers exceeds 10 million yuan. At present, the Cangzhou Shanshan Electrolyte Workshop has a production capacity of 20,000 tons and has been supplied to the outside world.

From the picture of the general control room, it can be seen that the arrangement of the general control room of Zhangzhou Shanshan will not exceed 10 people. The operator will monitor the scene in real time through the scenes of 15 sub-lenses, and all the data transmission and control room instructions will be transmitted. It is also controlled intelligently by the total system.

Targeting high-end customers for precise market positioning

After the establishment of the electrolyte integrated industrial chain, the Shanshan Electrolyte Business will focus on tracking and serving domestic and international high-end customers of digital, energy storage and power.

“It can be said that we are a factory designed and built in accordance with the national chemical standards and the standards of the international standard electrolyte production plant.” Guo Li said that in 2018, the company focused on the “2+1” market strategy: high-end digital and storage. Lithium battery customers are the mainstay, reducing the proportion of power business, mainly to follow the soft pack power battery customers of the main passenger cars.

With precise market positioning, high-end quality control, and intelligent production hardware, Shanshan has already possessed the soft and hard strength of international leading companies in the layout of electrolytes. In the future, we will focus on creating an integrated layout of electrolytes, and strive to become the “leading lithium battery electrolyte supplier”.